Investing in stocks can feel overwhelming for beginners. However, with a clear understanding and strategic approach, anyone can navigate this rewarding financial venture. This ultimate guide will demystify the process of stock investing, making it simple, understandable, and approachable for every beginner.

Contents

Understanding Investing in Stocks

Stocks represent ownership in a company. When you buy shares, you become a shareholder and own a portion of that business. Your shares’ value grows as the company grows, and you may earn dividends, a share of the profits, based on company performance.

Shares are units of ownership in a corporation. When you buy stocks, you purchase these units. Dividends, on the other hand, are earnings distributed by the company to shareholders periodically, often quarterly or annually. Companies are not obligated to pay dividends, but stable, profitable businesses frequently do.

Types of Stocks

Stocks are generally categorized into:

- Common Stocks: Most prevalent form of stock ownership, typically granting voting rights.

- Preferred Stocks: Typically provide fixed dividends but generally do not offer voting rights.

Why Investing in Stocks?

Investing in Stocks offers significant advantages, such as the potential for higher returns compared to savings accounts or bonds. Investing in stocks can help individuals build wealth over time through compound growth and dividend reinvestment.

Long-Term Growth

Historical data shows stock markets tend to rise in value over the long term, despite periodic volatility. Regular investing in stocks can significantly enhance your wealth-building potential.

Dividend Income

Dividend-paying stocks provide an additional income stream, particularly attractive to those seeking passive income or financial independence.

Getting Started with Investing in Stocks

Define Your Investment Goals

Clearly defining your financial goals helps you select suitable stocks. Are you saving for retirement, education, or a home? Each objective might require different investing strategies.

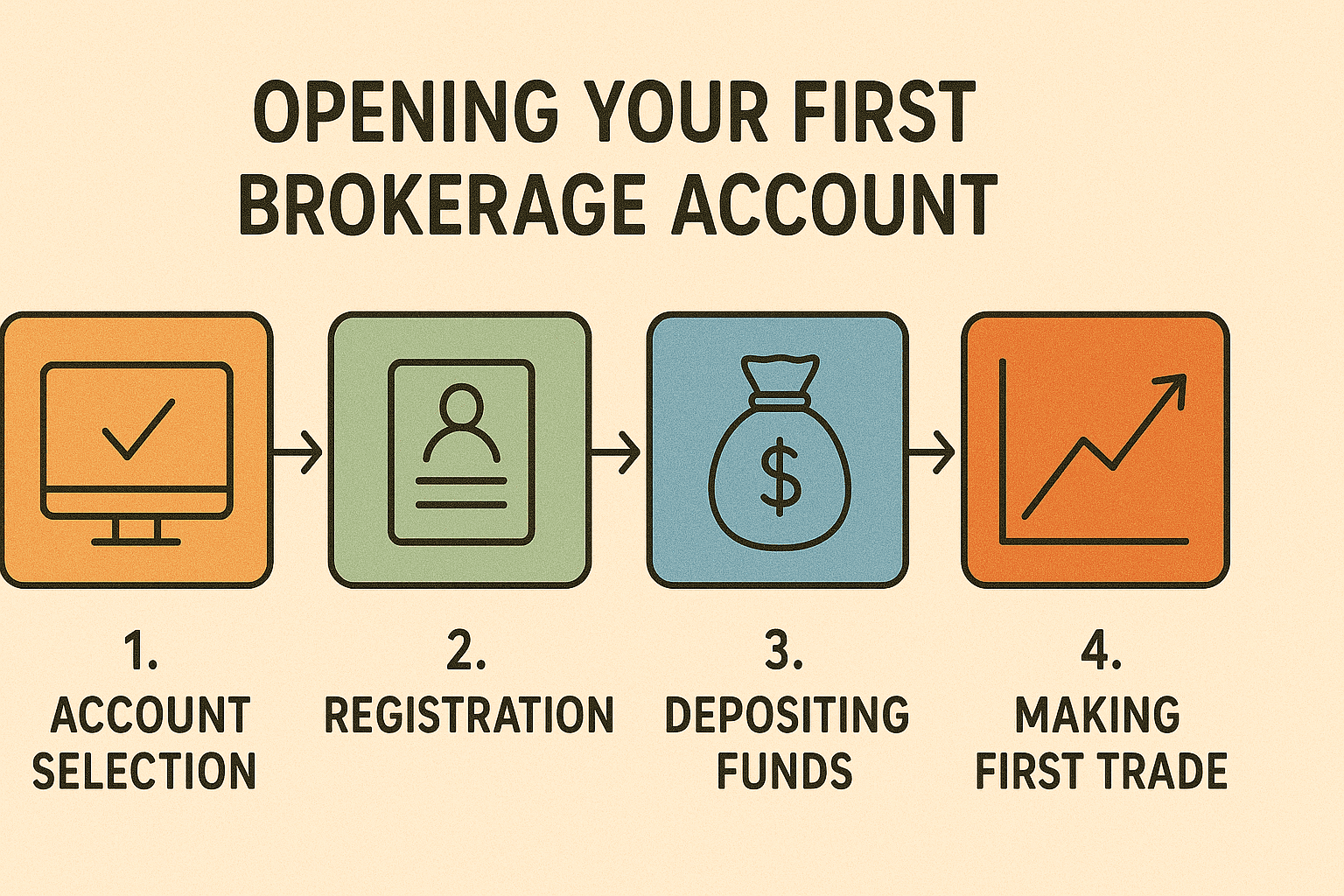

Choose the Right Brokerage Account

Opening a brokerage account is essential for trading stocks. Choose one based on ease of use, fees, educational resources, and customer service.

Understand Risk Tolerance

Risk tolerance refers to your ability and willingness to endure market fluctuations. Conservative investors prefer stable companies, while aggressive investors might select riskier, high-growth stocks.

Key Investment Strategies

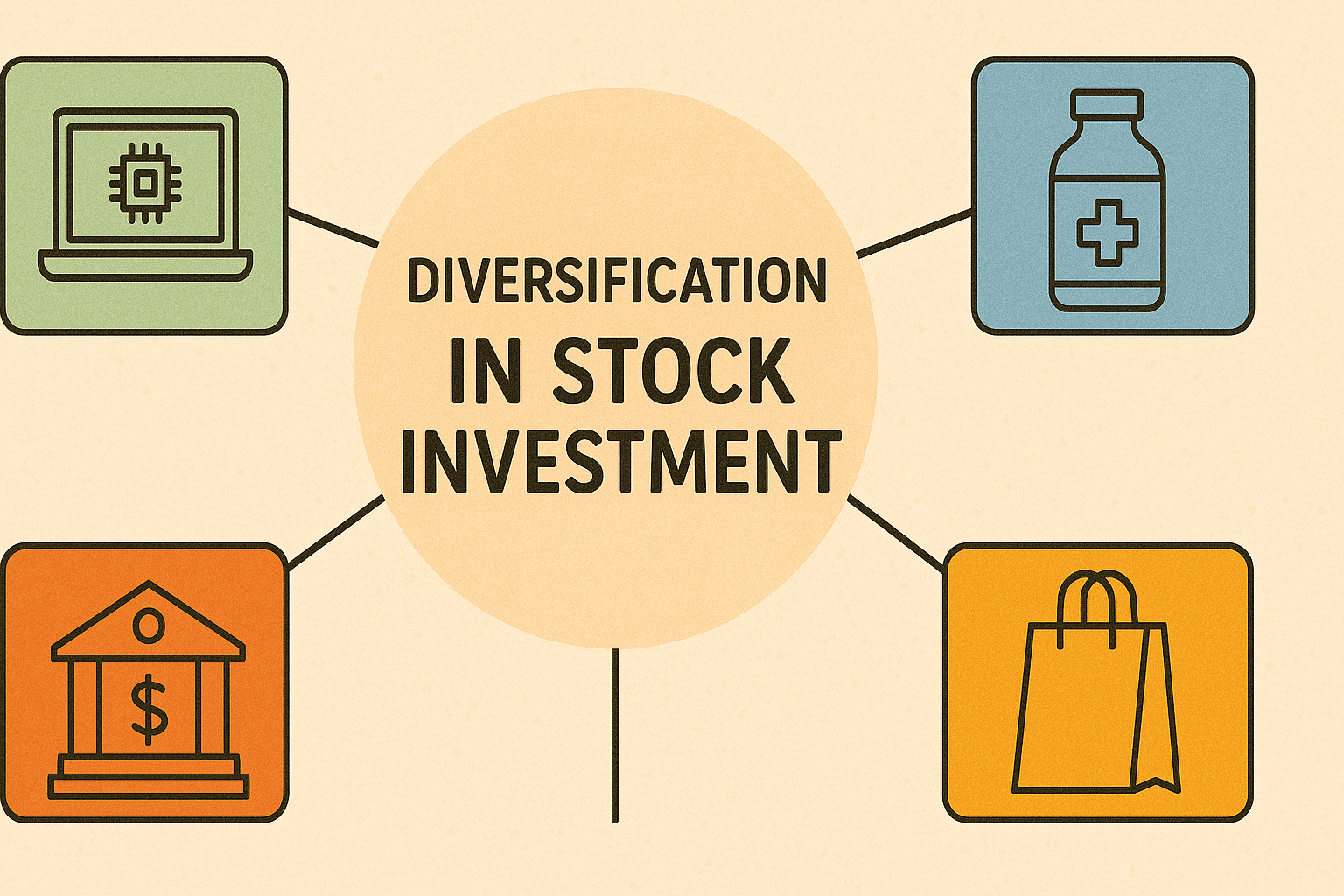

Diversification

Diversification spreads your investments across various industries and asset types, reducing the risk associated with market volatility. Avoid placing all your funds in one or two stocks, no matter how promising.

Long-term Holding

Holding stocks long-term typically yields better results than frequent trading. Investors who stay invested through market downturns generally benefit from eventual recoveries.

Regular Investment (Dollar-Cost Averaging)

Dollar-cost averaging involves investing a fixed sum regularly, regardless of stock prices. This approach can smooth out price volatility and reduce emotional decision-making.

Analyzing Stocks

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health, including revenues, earnings, debt, and market position. Tools like earnings reports and balance sheets help investors determine the value and stability of a stock.

Technical Analysis

Technical analysis focuses on patterns investing in stocks prices and trading volumes. This method is ideal for investors interested in short-term trading, though it requires practice and skill to master.

Common Mistakes to Avoid

Emotional Investing in Stocks

Reacting emotionally to market swings often leads to poor investment decisions. Developing discipline and maintaining a long-term view can significantly enhance your success.

Neglecting Research

Never invest blindly based on tips or rumors. Conduct thorough research or consult with financial advisors before making investment decisions.

Conclusion

Investing in stocks can seem daunting initially, but the process becomes manageable and exciting with the right knowledge and disciplined strategies. Understanding basic concepts, carefully planning, and remaining consistent in your investment approach will help you build wealth effectively over time.

Embrace the journey with patience and diligence, and you’ll be rewarded with financial growth and confidence.