Diversification is a cornerstone strategy in investment management. It involves spreading investments across various asset classes, sectors, and geographic regions to minimize risks and maximize returns. An effectively diversified portfolio helps investors mitigate potential losses and leverage opportunities for growth. Here’s a detailed guide on how to diversify your investment portfolio effectively.

Contents

Understanding the Importance of Diversification

Diversification serves as a protective shield against market volatility. When you diversify, your portfolio won’t rely solely on the performance of one investment or sector. This reduces the likelihood of catastrophic financial losses if one area of the market suffers significant declines.

Mitigating Risk

Risk management is a primary reason for diversification. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you ensure that a poor performing asset doesn’t significantly harm your overall portfolio. Different asset classes often respond uniquely to economic changes, thus providing a balanced approach to investment.

Enhancing Returns

Diversification not only limits losses but also positions your investments to capitalize on multiple growth opportunities. A well rounded portfolio benefits from different sectors performing well at different times, allowing you to consistently capture gains over the long term.

Key Steps to Diversifying Your Portfolio

Assess Your Investment Goals and Risk Tolerance

Clearly defining your financial objectives and risk tolerance is crucial before diversifying your portfolio. Are you investing for short term profits or long term growth? Are you comfortable with significant fluctuations, or do you prefer stability? Answering these questions will guide your diversification strategy.

Invest Across Different Asset Classes

One of the fundamental aspects of diversification is investing in varied asset classes, including:

- Stocks: Provide potential high returns but come with higher volatility.

- Bonds: Typically offer steady income and lower risk.

- Real Estate: Offers both capital appreciation and income generation.

- Commodities: Act as inflation hedges and diversification instruments.

Diversify Across Geographic Regions

Geographic diversification involves investing internationally to gain exposure to markets outside your home country. This strategy reduces the risk associated with relying solely on domestic economic conditions. International markets often behave differently due to varying economic cycles, political stability, and regulatory environments.

Diversify by Investment Styles

Investment styles include growth investing, value investing, and income investing. Diversifying by style means including a combination of stocks and funds that adopt different investment approaches. For example, growth stocks might excel during economic expansions, whereas value stocks often perform better during recovery phases.

Practical Tips for Effective Diversification

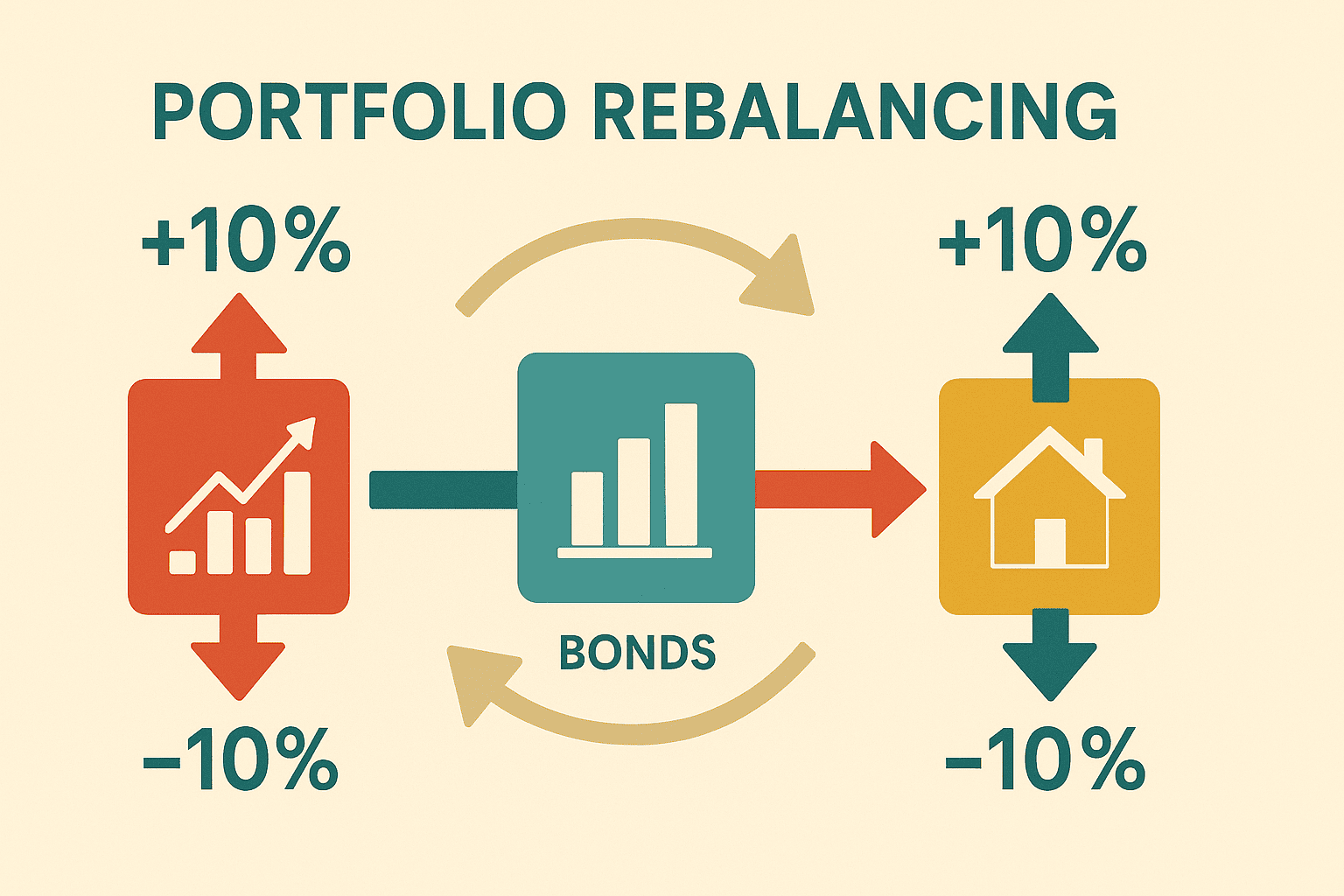

Regularly Rebalance Your Portfolio

Periodic rebalancing ensures that your portfolio maintains its intended risk profile and asset allocation. Over time, some investments will outperform others, skewing your original asset allocation. Regular rebalancing restores your diversification strategy, aligning your portfolio with your investment goals.

Avoid Over diversification

While diversification is essential, too many investments can dilute your potential returns. Over diversification can complicate portfolio management and increase costs. Aim to find a balance typically, a diversified portfolio contains between 15-30 individual investments or holdings, depending on your financial goals and resources.

Use Mutual Funds or ETFs

Mutual funds and Exchange Traded Funds (ETFs) offer built in diversification. They pool investors’ money to buy a diversified collection of securities, reducing individual security risk and providing exposure to multiple asset classes or sectors within a single investment.

Common Mistakes to Avoid

Ignoring Asset Correlation

Not all diversify strategies are effective. Investments that are highly correlated often move together, reducing diversify benefits. Choose assets with low correlation to achieve true diversification. For example, bonds generally have low correlation with stocks, which can stabilize your portfolio during market downturns.

Chasing Past Performance

Investors frequently make the mistake of investing heavily in assets or sectors that recently performed well. This can lead to concentration risk. A robust diversification strategy focuses on long term consistency rather than short term trends.

Monitoring and Adjusting Your Portfolio

Continuous Review

Investment portfolios require ongoing attention. Regularly monitor your investments’ performance and stay informed about market conditions. Adjustments may be necessary to respond to changing economic circumstances, life events, or financial goals.

Seek Professional Advice

Consider working with financial advisors who can help design and maintain a diversified portfolio tailored specifically to your financial goals, risk tolerance, and timeline. A professional can offer insights into market trends and investment opportunities that you might overlook on your own.

Conclusion

Diversifying your investment portfolio effectively requires deliberate planning, ongoing management, and periodic adjustments. By spreading your investments strategically across various asset classes, geographic locations, and investment styles, you can significantly reduce risks while capturing growth opportunities. Regular rebalancing, avoiding common mistakes, and seeking professional guidance will further enhance the effectiveness of your diversification strategy, leading to greater financial stability and growth.